Third Medium-Term Management Plan(FY2025 - FY2027)

Background to the Plan

The Mugen Estate Group has formulated a new corporate philosophy in its second medium-term management plan and has grown significantly, focusing on “Expansion of core business” and “Expansion and enhancement of growth businesses” as its business strategy.

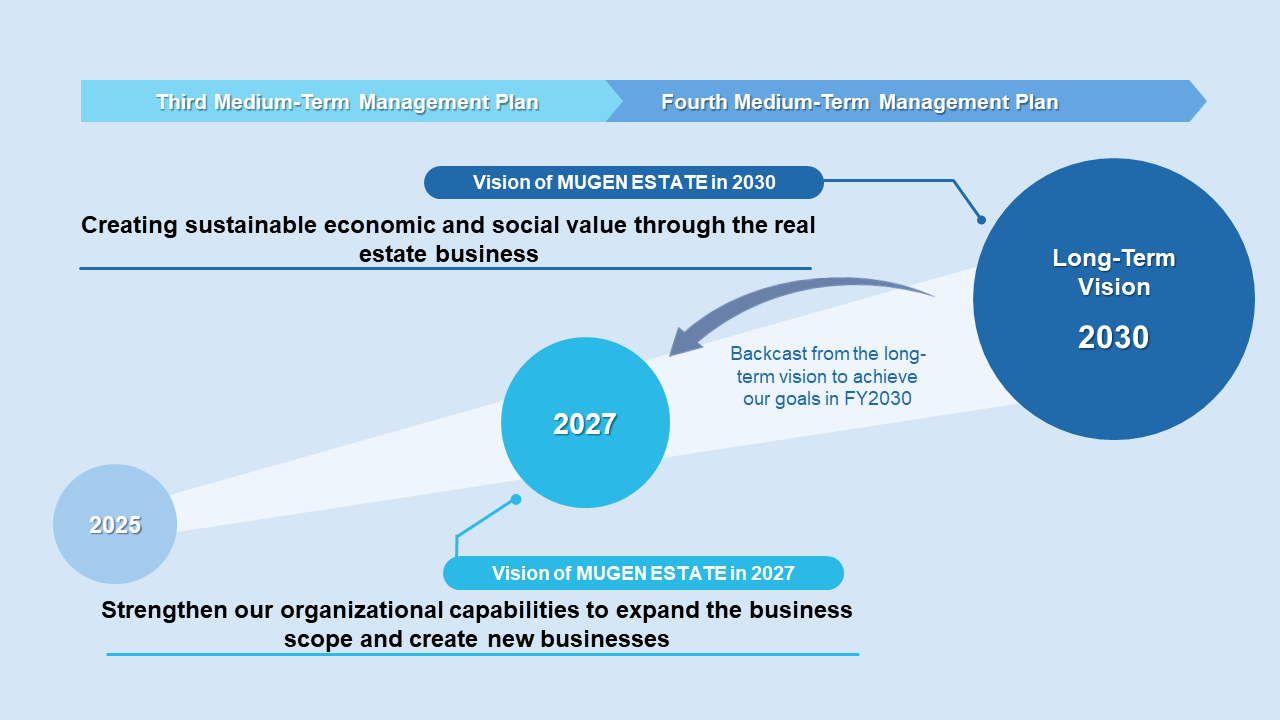

This time, we have established “Vision of MUGEN ESTATE in 2030” as our long-term vision, and through backcasting thinking toward achieving this long-term vision, we have formulated our third medium-term management plan with a deadline of the fiscal year December 2025 to the fiscal year December 2027.

Positioning of Third Medium-Term Management Plan

With a backcasting approach to achieving our long-term vision for the year 2030, we have set our vision for year 2027 as “strengthening our organizational capabilities to expand the business scope and create new businesses.”

The third medium-term management plan is positioned as a road map to reach this visoin in 2027.

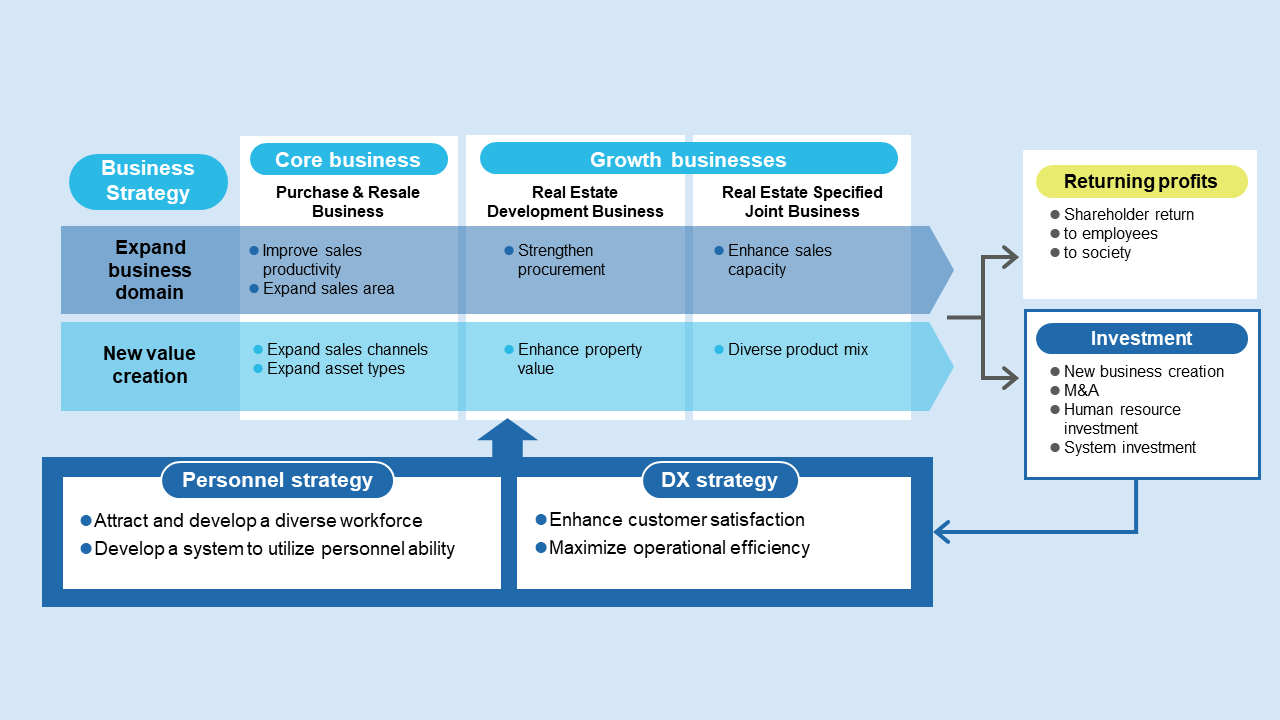

Summary of Strategy

Consolidated Results Targets(FY2025 - FY2027)

unit:Million yen

| FY2025 results |

FY2026 | FY2027 | FY2028 | |

|---|---|---|---|---|

| Net sales | 62,187 | 80,694 | 92,574 | 105,712 |

| Real Estate Trading Business | 59,758 | 77,727 | 88,731 | 100,925 |

| Real Estate Leasing and Other Business | 2,429 | 2,967 | 3,843 | 4,786 |

| Operating income | 9,623 | 10,961 | 12,143 | 14,428 |

| Ratio to net sales | 15.5% | 13.6% | 13.1% | 13.6% |

| Ordinary income | 8,858 | 9,955 | 11,026 | 13,248 |

| Ratio to net sales | 14.2% | 12.3% | 11.9% | 12.5% |

| Profit | 6,086 | 6,504 | 7,514 | 9,361 |

| Ratio to net sales | 9.8% | 8.1% | 8.1% | 8.9% |

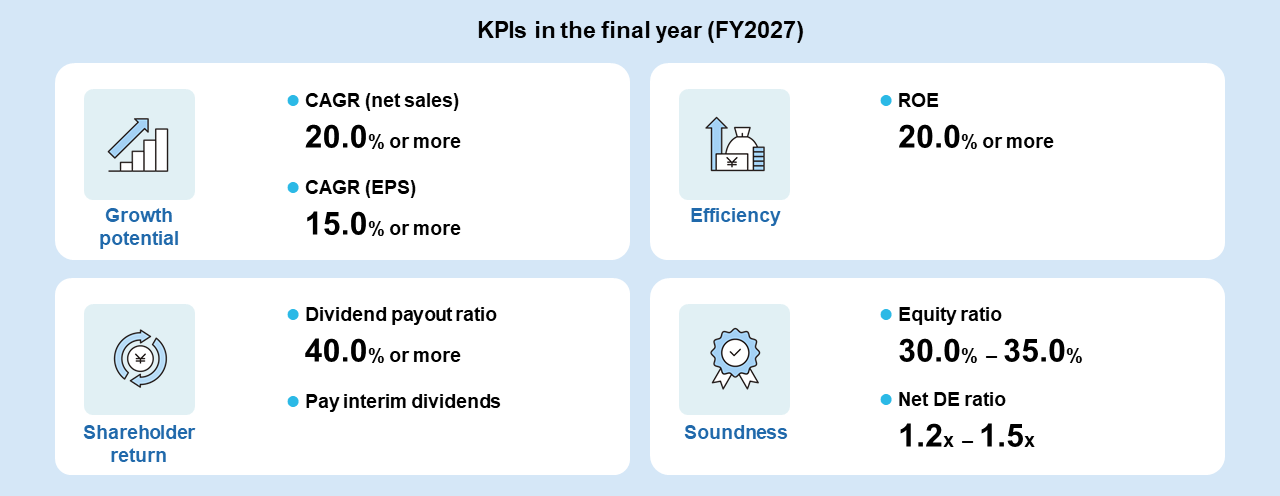

Key Performance Indicators (KPIs)

By pursuing an optimal balance between growth, capital efficiency, financial soundness, and shareholder returns, we will achieve the management that remains conscious of the cost of capital and stock price.

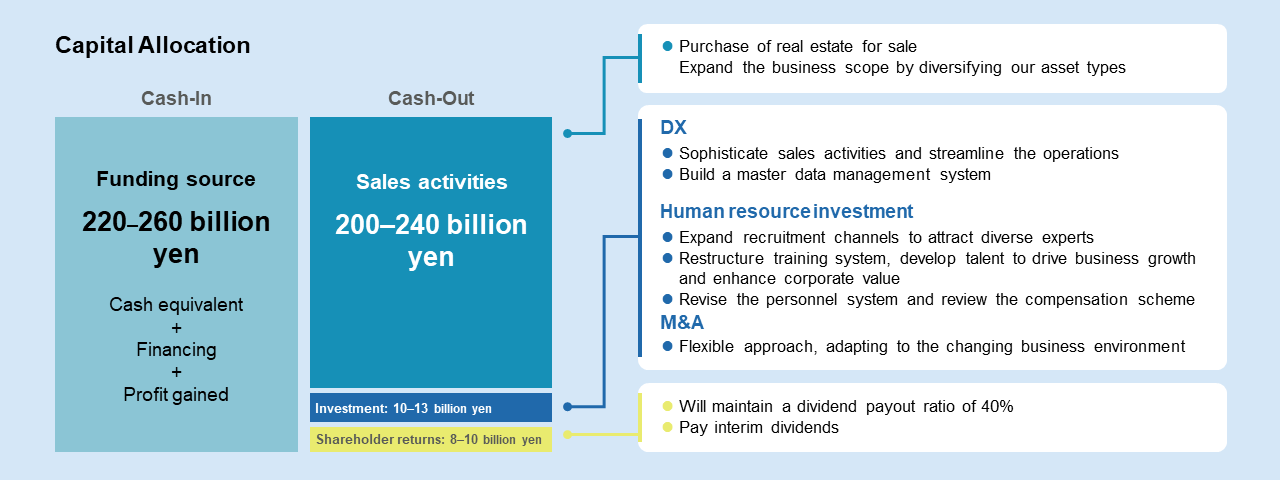

Capital Allocation

By maintaining financial soundness and enhancing funding diversification, we will accelerate the expansion and growth of our core businesses.

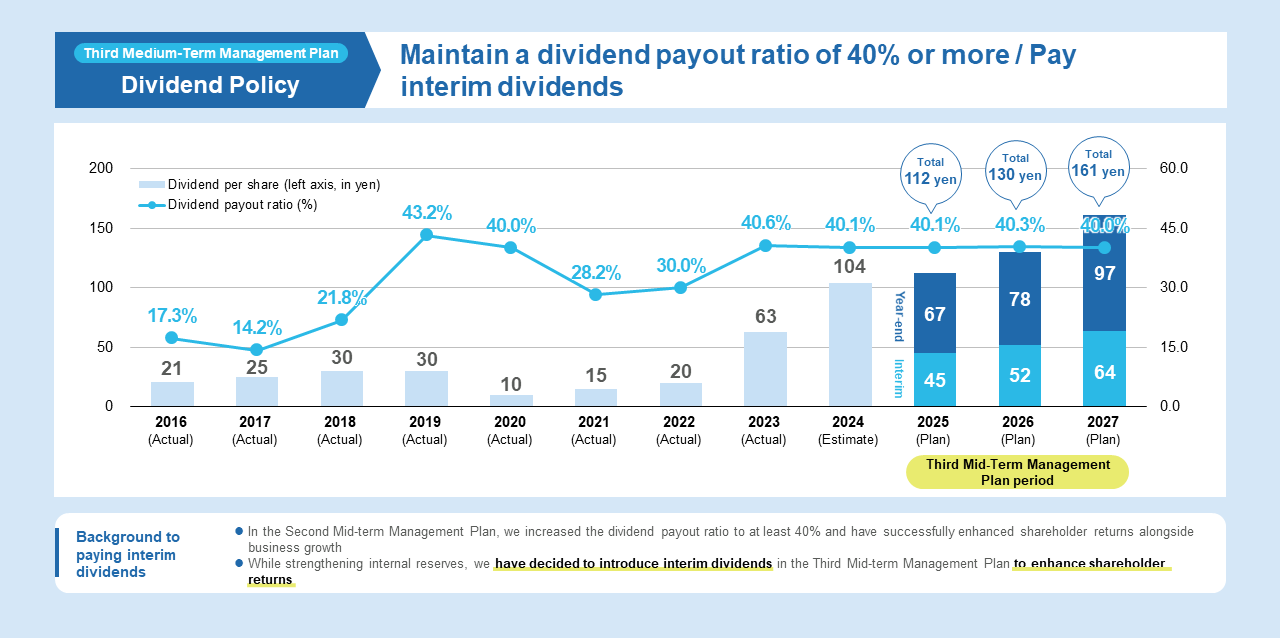

Dividend Policy